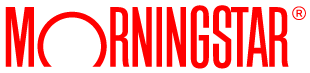

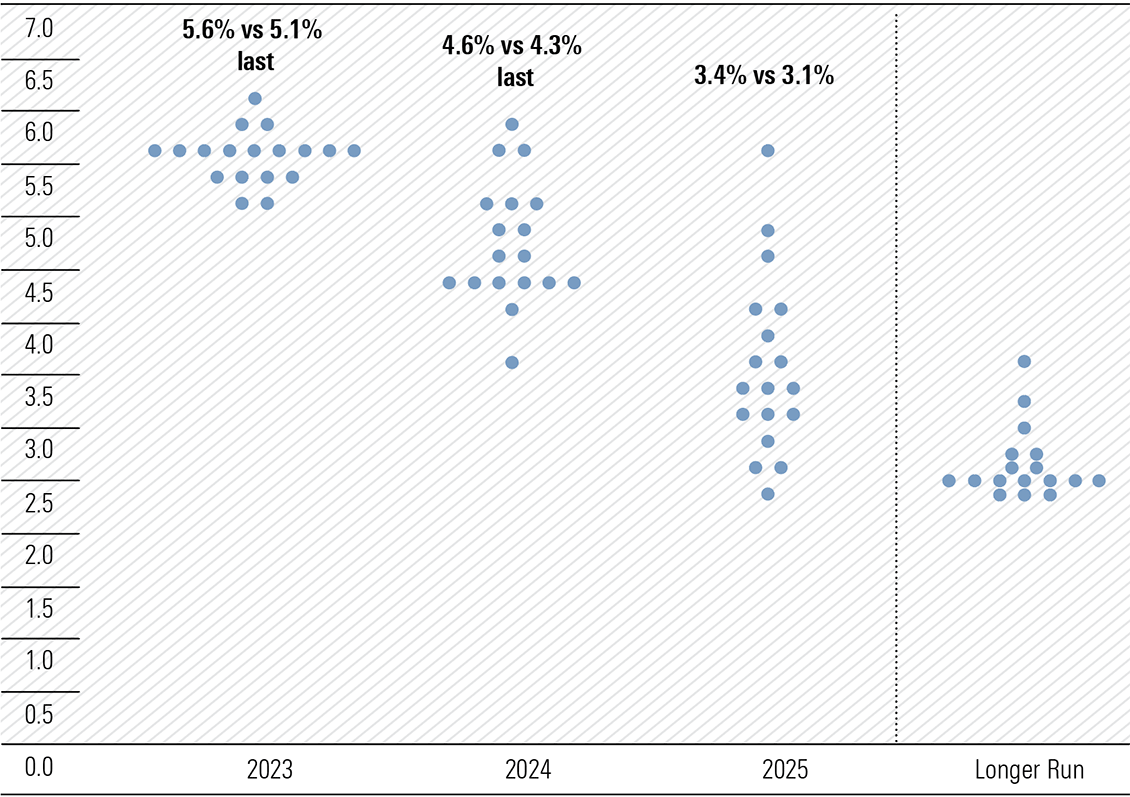

As expected, the US Federal Open Market Committee (FOMC) drew breath keeping the federal funds rate unchanged at 5.00%–5.25% at its 14 June meeting, the first pause since the tightening cycle began on 16 March 2022. However, chairman Jerome Powell stated at the post-meeting press conference the July meeting was “live” and the updated dot plot revealed further hikes are likely (Exhibit 1). The pause decision came a day after the May CPI data.

Source: US Federal Reserve

The Fed’s dot plot is a chart that records the projection of each FOMC member for the midpoint of the federal funds rate at the end of each calendar year for three years, and longer term. The current dot plot has the median rate at end 2023 at 5.6%, for 2024 4.6%, and 2025 3.4%, respectively. They reflect upward changes from March of 5.1%, 4.3%, and 3.1%, respectively.

Delving further, nine of the 18 members project a further two 25-basis point increases by year end, dominating the near term, and only two indicate no change. Clearly a hawkish bias dominates the thinking of the FOMC. It can only reflect anxiety and uncertainty around being able to drive the core CPI from the current 5.3% well into the 3% zone. Remember further rate hikes are predicted, despite the forecast of real GDP growth of 1% for 2023 and 1.1% in 2024.

The US economy, like others, is teetering on contraction in the back half of 2023. Further rate rises are almost certain to deliver a contraction. Meanwhile, financial markets will have to deal with the US Treasury issuing up to US$1 trillion in new Treasuries and other securities by the end of 2023 following the lifting of the debt ceiling until January 2025. Liquidity in the financial system is about to be meaningfully reduced, and in addition to the Fed still trimming its balance sheet under the quantitative tightening program.

There were no surprises in the US May CPI data with the inflation rate continuing to ease. Both headline and core readings were in line with expectations and equity markets moved moderately higher, as no demons emerged to push the FOMC to raise the federal funds rate.

Initially, bond yields fell on the release, but rebounded to close sharply higher, particularly at the shorter end, as the curve flattened. The 2-year yield traded across an intraday range of 4.45%-4.71%, closing at 4.67%, with the benchmark 10-year yield falling below 3.70% before closing at 3.81%. The 2/10-year spread widened to a negative 86-basis points.

Headline CPI rose 0.1% month-on-month (m/m), down from the 0.4% increase in April, marking the 11th consecutive monthly decline. The 4.0% year-on-year (y/y), which was down sharply from April’s 4.9%, is a far cry from the 9.1% peak in June 2022. The decline was helped by a 5.6% fall in gasoline prices after a 3% increase in April and the base effect from a high reading in May 2022, with the latter also providing downward influence in June. A 4.4% spike in used car and truck prices in the month was the only meaningful rise.

At the core level, excluding food and energy, the index rose 0.4% m/m, the same as April and March, and by 5.3% y/y and a much more subdued move downward from April’s 5.5%. It has been a slow grind to get the core down from 6.0% a year ago.

Source: US Federal Reserve

The Fed’s dot plot is a chart that records the projection of each FOMC member for the midpoint of the federal funds rate at the end of each calendar year for three years, and longer term. The current dot plot has the median rate at end 2023 at 5.6%, for 2024 4.6%, and 2025 3.4%, respectively. They reflect upward changes from March of 5.1%, 4.3%, and 3.1%, respectively.

Delving further, nine of the 18 members project a further two 25-basis point increases by year end, dominating the near term, and only two indicate no change. Clearly a hawkish bias dominates the thinking of the FOMC. It can only reflect anxiety and uncertainty around being able to drive the core CPI from the current 5.3% well into the 3% zone. Remember further rate hikes are predicted, despite the forecast of real GDP growth of 1% for 2023 and 1.1% in 2024.

The US economy, like others, is teetering on contraction in the back half of 2023. Further rate rises are almost certain to deliver a contraction. Meanwhile, financial markets will have to deal with the US Treasury issuing up to US$1 trillion in new Treasuries and other securities by the end of 2023 following the lifting of the debt ceiling until January 2025. Liquidity in the financial system is about to be meaningfully reduced, and in addition to the Fed still trimming its balance sheet under the quantitative tightening program.

There were no surprises in the US May CPI data with the inflation rate continuing to ease. Both headline and core readings were in line with expectations and equity markets moved moderately higher, as no demons emerged to push the FOMC to raise the federal funds rate.

Initially, bond yields fell on the release, but rebounded to close sharply higher, particularly at the shorter end, as the curve flattened. The 2-year yield traded across an intraday range of 4.45%-4.71%, closing at 4.67%, with the benchmark 10-year yield falling below 3.70% before closing at 3.81%. The 2/10-year spread widened to a negative 86-basis points.

Headline CPI rose 0.1% month-on-month (m/m), down from the 0.4% increase in April, marking the 11th consecutive monthly decline. The 4.0% year-on-year (y/y), which was down sharply from April’s 4.9%, is a far cry from the 9.1% peak in June 2022. The decline was helped by a 5.6% fall in gasoline prices after a 3% increase in April and the base effect from a high reading in May 2022, with the latter also providing downward influence in June. A 4.4% spike in used car and truck prices in the month was the only meaningful rise.

At the core level, excluding food and energy, the index rose 0.4% m/m, the same as April and March, and by 5.3% y/y and a much more subdued move downward from April’s 5.5%. It has been a slow grind to get the core down from 6.0% a year ago.

Source: Bureau of Labor Statistics

While the trend is certainly encouraging, the core reading is still too high and remains well above the Fed’s desired level. The Fed’s target is 2% for the preferred core Personal Consumption Expenditures (PCE) index and it is still far too early to claim mission accomplished in the two-year battle against what was initially tagged as transitory inflation.

Commentators pointed to narrower core readings providing optimism. Core, excluding shelter and used car and truck prices, rose 0.1% m/m and by 2.3% on a three-month annualised basis, with suggestions subsequent lower auction prices will remove used car and truck increases in June. A 10.2% increase in transportation services was the largest annual rise, beating an 8% lift in shelter. Core, excluding everything, was unchanged!

Source: Bureau of Labor Statistics

While the trend is certainly encouraging, the core reading is still too high and remains well above the Fed’s desired level. The Fed’s target is 2% for the preferred core Personal Consumption Expenditures (PCE) index and it is still far too early to claim mission accomplished in the two-year battle against what was initially tagged as transitory inflation.

Commentators pointed to narrower core readings providing optimism. Core, excluding shelter and used car and truck prices, rose 0.1% m/m and by 2.3% on a three-month annualised basis, with suggestions subsequent lower auction prices will remove used car and truck increases in June. A 10.2% increase in transportation services was the largest annual rise, beating an 8% lift in shelter. Core, excluding everything, was unchanged!

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

Source: National Australia Bank, Macrobond

While absorbing this information, today’s Labour Force report for May completely blindsided markets. In seasonally adjusted terms, employment increased by 75,900 after a loss of 4,000 in April. Full-time increased by 61,700 and part-time by 14,300. The unemployment rate fell from 3.7% to 3.6%. Consensus forecasts were for employment to increase by 17,500 and an unchanged unemployment rate of 3.7%. The participation rate moved higher to a record 66.9%. Monthly hours worked were 4.8% above May 2022 levels. I suspect output lagged the increase in hours worked.

The Reserve Bank is at the mercy of incoming data. The May Labour Force report and the tightness of the labour market leaves it with little option but to hike in July to 4.35%. Employment growth is underpinning household income and supporting consumer spending which adds to inflationary pressure.

To get the inflation genie back into the bottle we will have to see a change in the mindset of consumers, and it will probably require a deeper recession than currently anticipated. The only way to reverse the decline in living standards must come from a meaningful improvement in labour productivity—to lift output at a faster rate than hours worked. It includes all workers in all sectors of the economy, both public and private. A reality check could be around the corner should the unemployment rate spike. The fear of losing your job should alter behaviour.

Monetary policy is trying to slow the rate of growth in aggregate demand. It appears fiscal policy is not supportive. The Queensland budget’s hand out $550 to every household, reminiscent of Kevin Rudd’s $900 for all, dead or alive, is an example.

Interesting times ahead and I remain cautious.

Source: National Australia Bank, Macrobond

While absorbing this information, today’s Labour Force report for May completely blindsided markets. In seasonally adjusted terms, employment increased by 75,900 after a loss of 4,000 in April. Full-time increased by 61,700 and part-time by 14,300. The unemployment rate fell from 3.7% to 3.6%. Consensus forecasts were for employment to increase by 17,500 and an unchanged unemployment rate of 3.7%. The participation rate moved higher to a record 66.9%. Monthly hours worked were 4.8% above May 2022 levels. I suspect output lagged the increase in hours worked.

The Reserve Bank is at the mercy of incoming data. The May Labour Force report and the tightness of the labour market leaves it with little option but to hike in July to 4.35%. Employment growth is underpinning household income and supporting consumer spending which adds to inflationary pressure.

To get the inflation genie back into the bottle we will have to see a change in the mindset of consumers, and it will probably require a deeper recession than currently anticipated. The only way to reverse the decline in living standards must come from a meaningful improvement in labour productivity—to lift output at a faster rate than hours worked. It includes all workers in all sectors of the economy, both public and private. A reality check could be around the corner should the unemployment rate spike. The fear of losing your job should alter behaviour.

Monetary policy is trying to slow the rate of growth in aggregate demand. It appears fiscal policy is not supportive. The Queensland budget’s hand out $550 to every household, reminiscent of Kevin Rudd’s $900 for all, dead or alive, is an example.

Interesting times ahead and I remain cautious.

Exhibit 1: FOMC participants’ assessments of appropriate monetary policy: Midpoint of target range or target level for the federal funds rate (%)

Source: US Federal Reserve

The Fed’s dot plot is a chart that records the projection of each FOMC member for the midpoint of the federal funds rate at the end of each calendar year for three years, and longer term. The current dot plot has the median rate at end 2023 at 5.6%, for 2024 4.6%, and 2025 3.4%, respectively. They reflect upward changes from March of 5.1%, 4.3%, and 3.1%, respectively.

Delving further, nine of the 18 members project a further two 25-basis point increases by year end, dominating the near term, and only two indicate no change. Clearly a hawkish bias dominates the thinking of the FOMC. It can only reflect anxiety and uncertainty around being able to drive the core CPI from the current 5.3% well into the 3% zone. Remember further rate hikes are predicted, despite the forecast of real GDP growth of 1% for 2023 and 1.1% in 2024.

The US economy, like others, is teetering on contraction in the back half of 2023. Further rate rises are almost certain to deliver a contraction. Meanwhile, financial markets will have to deal with the US Treasury issuing up to US$1 trillion in new Treasuries and other securities by the end of 2023 following the lifting of the debt ceiling until January 2025. Liquidity in the financial system is about to be meaningfully reduced, and in addition to the Fed still trimming its balance sheet under the quantitative tightening program.

There were no surprises in the US May CPI data with the inflation rate continuing to ease. Both headline and core readings were in line with expectations and equity markets moved moderately higher, as no demons emerged to push the FOMC to raise the federal funds rate.

Initially, bond yields fell on the release, but rebounded to close sharply higher, particularly at the shorter end, as the curve flattened. The 2-year yield traded across an intraday range of 4.45%-4.71%, closing at 4.67%, with the benchmark 10-year yield falling below 3.70% before closing at 3.81%. The 2/10-year spread widened to a negative 86-basis points.

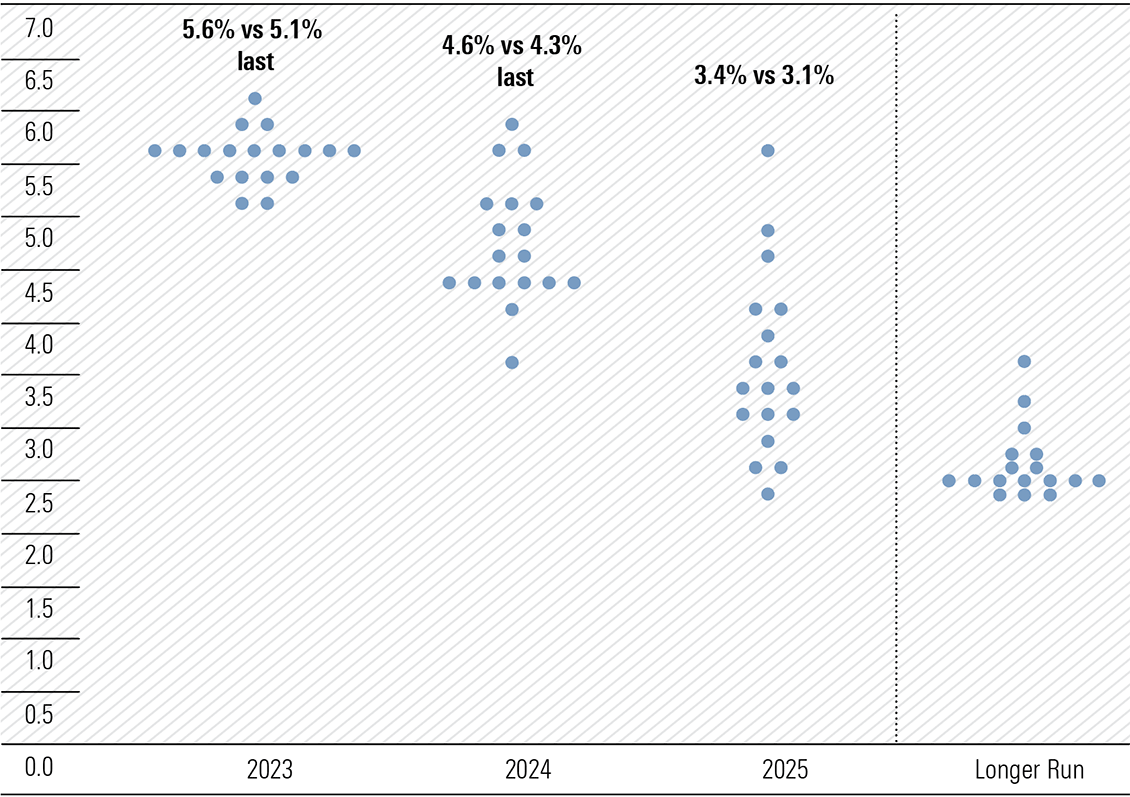

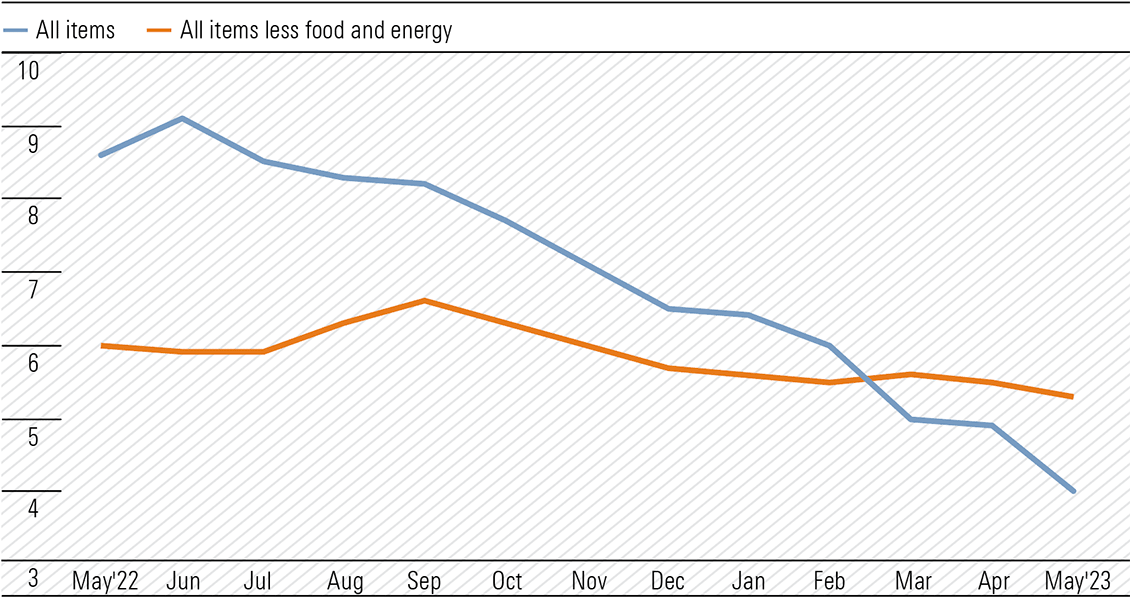

Headline CPI rose 0.1% month-on-month (m/m), down from the 0.4% increase in April, marking the 11th consecutive monthly decline. The 4.0% year-on-year (y/y), which was down sharply from April’s 4.9%, is a far cry from the 9.1% peak in June 2022. The decline was helped by a 5.6% fall in gasoline prices after a 3% increase in April and the base effect from a high reading in May 2022, with the latter also providing downward influence in June. A 4.4% spike in used car and truck prices in the month was the only meaningful rise.

At the core level, excluding food and energy, the index rose 0.4% m/m, the same as April and March, and by 5.3% y/y and a much more subdued move downward from April’s 5.5%. It has been a slow grind to get the core down from 6.0% a year ago.

Source: US Federal Reserve

The Fed’s dot plot is a chart that records the projection of each FOMC member for the midpoint of the federal funds rate at the end of each calendar year for three years, and longer term. The current dot plot has the median rate at end 2023 at 5.6%, for 2024 4.6%, and 2025 3.4%, respectively. They reflect upward changes from March of 5.1%, 4.3%, and 3.1%, respectively.

Delving further, nine of the 18 members project a further two 25-basis point increases by year end, dominating the near term, and only two indicate no change. Clearly a hawkish bias dominates the thinking of the FOMC. It can only reflect anxiety and uncertainty around being able to drive the core CPI from the current 5.3% well into the 3% zone. Remember further rate hikes are predicted, despite the forecast of real GDP growth of 1% for 2023 and 1.1% in 2024.

The US economy, like others, is teetering on contraction in the back half of 2023. Further rate rises are almost certain to deliver a contraction. Meanwhile, financial markets will have to deal with the US Treasury issuing up to US$1 trillion in new Treasuries and other securities by the end of 2023 following the lifting of the debt ceiling until January 2025. Liquidity in the financial system is about to be meaningfully reduced, and in addition to the Fed still trimming its balance sheet under the quantitative tightening program.

There were no surprises in the US May CPI data with the inflation rate continuing to ease. Both headline and core readings were in line with expectations and equity markets moved moderately higher, as no demons emerged to push the FOMC to raise the federal funds rate.

Initially, bond yields fell on the release, but rebounded to close sharply higher, particularly at the shorter end, as the curve flattened. The 2-year yield traded across an intraday range of 4.45%-4.71%, closing at 4.67%, with the benchmark 10-year yield falling below 3.70% before closing at 3.81%. The 2/10-year spread widened to a negative 86-basis points.

Headline CPI rose 0.1% month-on-month (m/m), down from the 0.4% increase in April, marking the 11th consecutive monthly decline. The 4.0% year-on-year (y/y), which was down sharply from April’s 4.9%, is a far cry from the 9.1% peak in June 2022. The decline was helped by a 5.6% fall in gasoline prices after a 3% increase in April and the base effect from a high reading in May 2022, with the latter also providing downward influence in June. A 4.4% spike in used car and truck prices in the month was the only meaningful rise.

At the core level, excluding food and energy, the index rose 0.4% m/m, the same as April and March, and by 5.3% y/y and a much more subdued move downward from April’s 5.5%. It has been a slow grind to get the core down from 6.0% a year ago.

Exhibit 2: 12-month percent change in CPI for All Urban Consumers (CPI-U), not seasonally adjusted, May 2022 - May 2023 (% change)

Source: Bureau of Labor Statistics

While the trend is certainly encouraging, the core reading is still too high and remains well above the Fed’s desired level. The Fed’s target is 2% for the preferred core Personal Consumption Expenditures (PCE) index and it is still far too early to claim mission accomplished in the two-year battle against what was initially tagged as transitory inflation.

Commentators pointed to narrower core readings providing optimism. Core, excluding shelter and used car and truck prices, rose 0.1% m/m and by 2.3% on a three-month annualised basis, with suggestions subsequent lower auction prices will remove used car and truck increases in June. A 10.2% increase in transportation services was the largest annual rise, beating an 8% lift in shelter. Core, excluding everything, was unchanged!

Source: Bureau of Labor Statistics

While the trend is certainly encouraging, the core reading is still too high and remains well above the Fed’s desired level. The Fed’s target is 2% for the preferred core Personal Consumption Expenditures (PCE) index and it is still far too early to claim mission accomplished in the two-year battle against what was initially tagged as transitory inflation.

Commentators pointed to narrower core readings providing optimism. Core, excluding shelter and used car and truck prices, rose 0.1% m/m and by 2.3% on a three-month annualised basis, with suggestions subsequent lower auction prices will remove used car and truck increases in June. A 10.2% increase in transportation services was the largest annual rise, beating an 8% lift in shelter. Core, excluding everything, was unchanged!

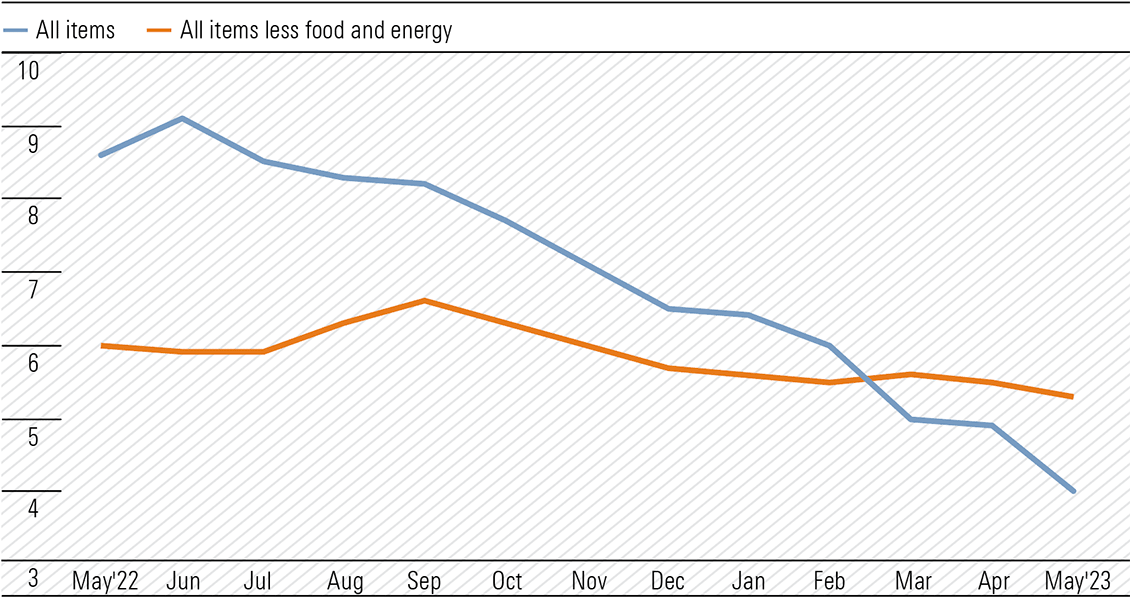

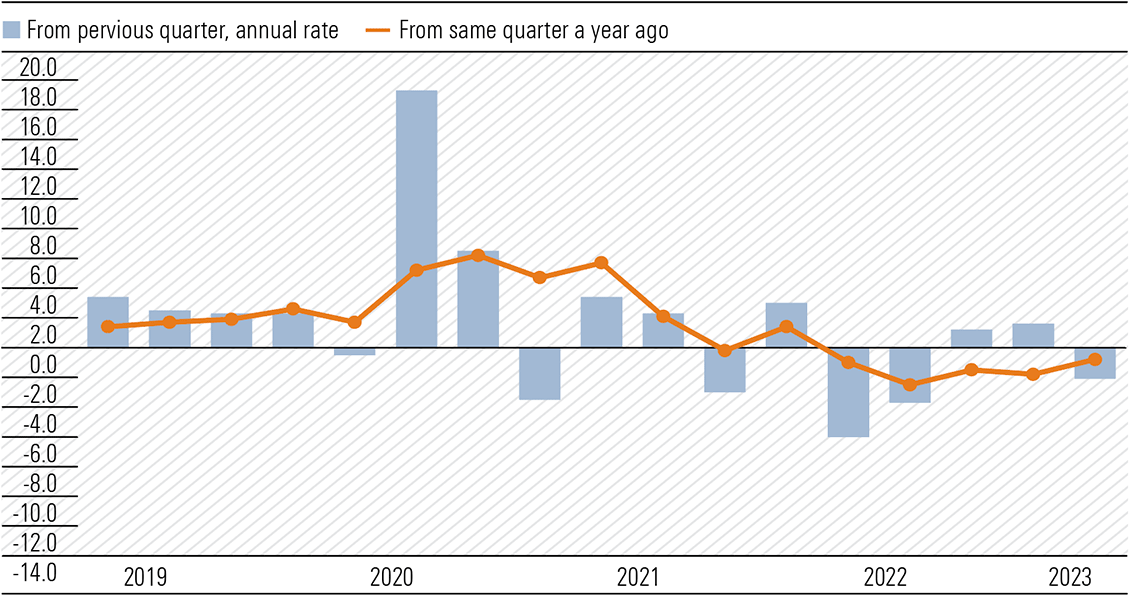

US productivity also on the nose

It appears Australia is not the only country with a labour productivity problem. In 1Q23, US nonfarm business sector labor productivity declined 2.1% as output increased by 0.5% and hours worked increased by 2.6% from 4Q22. In 1Q22 productivity declined by 0.8%, reflecting a 1.4% lift in output and a 2.2% increase in hours worked. The Bureau of Labor Statistics reported the productivity decline “is the first time the four-quarter change series has remained negative for five consecutive quarters”, marking the longest period of contraction since the series began in the first quarter of 1948.Exhibit 3: Labor productivity, nonfarm business, 2019Q1 – 2023Q1 (% change)

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

US credit crunch starts taking prisoners

Aggressive cumulative interest rate increases of 5.00% are finally taking a toll as a credit crunch looms. Defaults of a not inconsiderable US$21bn have occurred in the first five months of 2023, with the monthly rate accelerating to US$7.8bn in May. The cost of servicing leveraged/floating rate loans taken out by high-risk companies when the federal funds rate was near zero have reached breakpoint. The chances of refinancing these junk-rated loans are also probably zero. This, as credit availability is contracting rapidly. Investors who purchased these “collateralised loan obligations” are looking over a cliff. The latest quarterly Fed Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices revealed lending standards had tightened across all institutions and across all lending categories—commercial and industrial as well as household loan instruments including mortgages, home equity lines of credit and credit cards. The tightening was in the wake of the problems that unfolded in the regional banking sector following the failure of Silicon Valley Bank and Signature Bank and the rescue/sale of First Republic Bank. Internationally, Credit Suisse morphed into Debit Suisse and was swallowed at an apparent bargain price by UBS. The holders of Credit Suisse hybrids saw their investment evaporate. Recall in March, the Fed’s in-house economists warned tightening credit conditions alone would likely cause a shallow recession. The next SLOOS report is due early August, and the picture will have only darkened.Australia’s consumer sentiment bottoming?

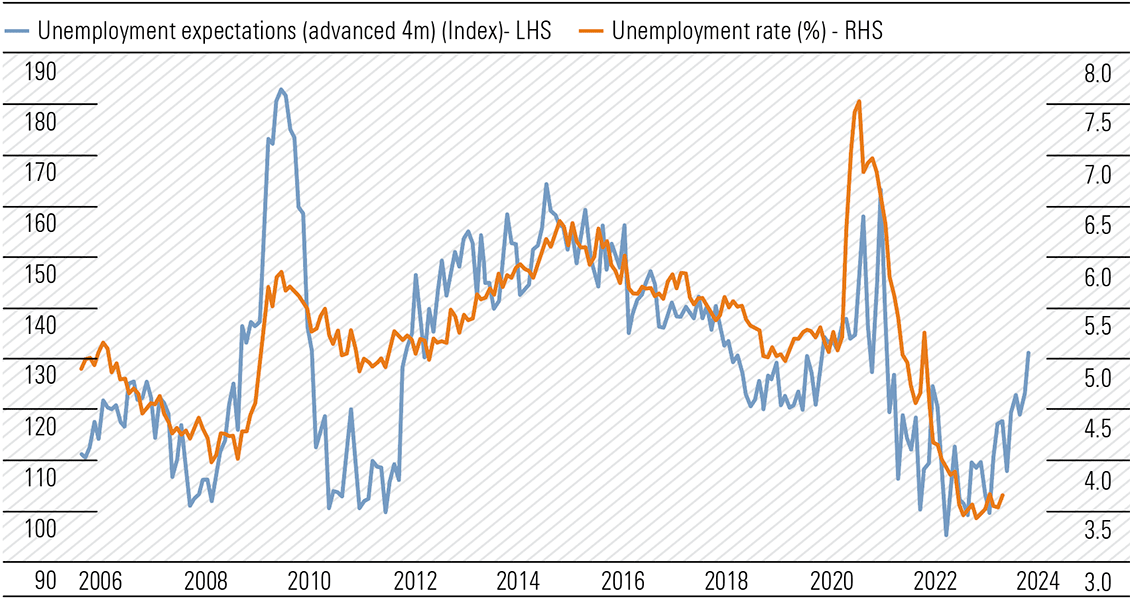

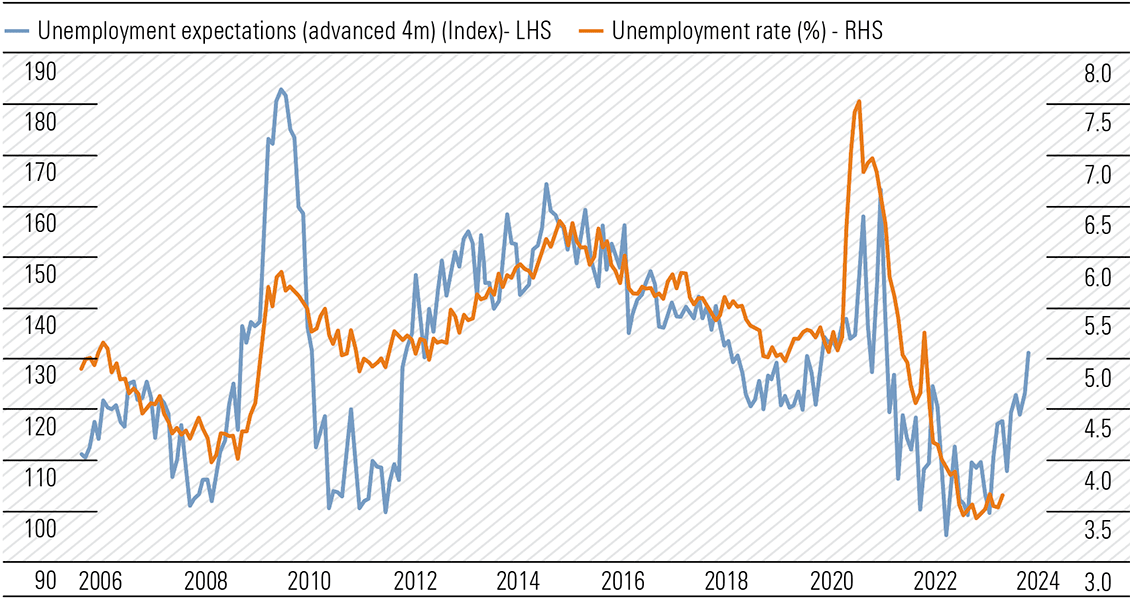

The Westpac-Melbourne Institute Consumer Sentiment index is showing signs of bottoming around the lows reached in 2022 and those of the late 1980s-early 1990s recession. The index edged marginally higher from 79 in May to 79.2 in June. The survey was taken between 5-9 June and while improvement is encouraging, there was a sharp decline in confidence from respondents after the Reserve Bank’s rate hike on 6 June. Clearly, the surprise element in the timing of the increase and the subsequent hawkish tone of RBA governor Philip Lowe’s commentary hit home. Additionally, there was a meaningful lift in unemployment expectations, with the sub-index lifting to the highest level since September 2020. Given the traditional lag effect, the unemployment rate could move sharply through 4% by early 2024.Exhibit 4: Unemployment expectations rose sharply

Source: National Australia Bank, Macrobond

While absorbing this information, today’s Labour Force report for May completely blindsided markets. In seasonally adjusted terms, employment increased by 75,900 after a loss of 4,000 in April. Full-time increased by 61,700 and part-time by 14,300. The unemployment rate fell from 3.7% to 3.6%. Consensus forecasts were for employment to increase by 17,500 and an unchanged unemployment rate of 3.7%. The participation rate moved higher to a record 66.9%. Monthly hours worked were 4.8% above May 2022 levels. I suspect output lagged the increase in hours worked.

The Reserve Bank is at the mercy of incoming data. The May Labour Force report and the tightness of the labour market leaves it with little option but to hike in July to 4.35%. Employment growth is underpinning household income and supporting consumer spending which adds to inflationary pressure.

To get the inflation genie back into the bottle we will have to see a change in the mindset of consumers, and it will probably require a deeper recession than currently anticipated. The only way to reverse the decline in living standards must come from a meaningful improvement in labour productivity—to lift output at a faster rate than hours worked. It includes all workers in all sectors of the economy, both public and private. A reality check could be around the corner should the unemployment rate spike. The fear of losing your job should alter behaviour.

Monetary policy is trying to slow the rate of growth in aggregate demand. It appears fiscal policy is not supportive. The Queensland budget’s hand out $550 to every household, reminiscent of Kevin Rudd’s $900 for all, dead or alive, is an example.

Interesting times ahead and I remain cautious.

Source: National Australia Bank, Macrobond

While absorbing this information, today’s Labour Force report for May completely blindsided markets. In seasonally adjusted terms, employment increased by 75,900 after a loss of 4,000 in April. Full-time increased by 61,700 and part-time by 14,300. The unemployment rate fell from 3.7% to 3.6%. Consensus forecasts were for employment to increase by 17,500 and an unchanged unemployment rate of 3.7%. The participation rate moved higher to a record 66.9%. Monthly hours worked were 4.8% above May 2022 levels. I suspect output lagged the increase in hours worked.

The Reserve Bank is at the mercy of incoming data. The May Labour Force report and the tightness of the labour market leaves it with little option but to hike in July to 4.35%. Employment growth is underpinning household income and supporting consumer spending which adds to inflationary pressure.

To get the inflation genie back into the bottle we will have to see a change in the mindset of consumers, and it will probably require a deeper recession than currently anticipated. The only way to reverse the decline in living standards must come from a meaningful improvement in labour productivity—to lift output at a faster rate than hours worked. It includes all workers in all sectors of the economy, both public and private. A reality check could be around the corner should the unemployment rate spike. The fear of losing your job should alter behaviour.

Monetary policy is trying to slow the rate of growth in aggregate demand. It appears fiscal policy is not supportive. The Queensland budget’s hand out $550 to every household, reminiscent of Kevin Rudd’s $900 for all, dead or alive, is an example.

Interesting times ahead and I remain cautious.