At a time when the Australian Prudential Regulation Authority is calling on Australian super fund trustees to improve the frequency and methodology used in unlisted asset valuations, perhaps we should also remind ourselves how abysmal Australia's portfolio holdings disclosure requirements are when compared with other countries'. Australia's compulsory superannuation system operates in a dark void for investors. A consistent finding from Morningstar's Global Investor Experience studies, which assess the retail investor experience across 26 markets, is that Australia has the feeblest investment fund disclosure requirements on the planet. Put simply, Australian investors have limited regulated rights to know what securities (stocks and bonds) their investment and superannuation funds hold in their portfolios.

The flaws in the Australian Portfolio Holdings Disclosure Regulations released in November 2021 are many, but Morningstar would call out these specific points:

Australia's current portfolio holdings regulations offer little value to Australian investors and do not exceed the lowest bar that Morningstar sees in disclosure regulations in other global markets. In Australia's compulsory superannuation system, investors' best interests are not being served by weak portfolio holdings disclosure regulations

Australia's current portfolio holdings regulations offer little value to Australian investors and do not exceed the lowest bar that Morningstar sees in disclosure regulations in other global markets. In Australia's compulsory superannuation system, investors' best interests are not being served by weak portfolio holdings disclosure regulations

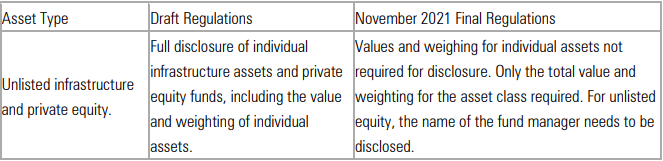

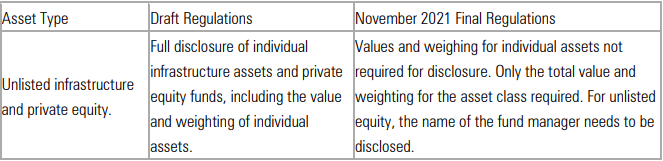

- For unlisted infrastructure and private equity, the values and weightings for individual assets are not required for disclosure. Only the total value and weighting for the asset class are required. For unlisted equity, the name of the fund manager needs to be disclosed. (Currently, this allows some super fund investors to play a game of "Where could my Canva holding be?")

- The disclosure requirement of simple asset types like bonds is opaque, making these disclosures meaningless. Simply listing the issuer of a bond tells investors nothing about its credit quality and interest-rate risk.

- If a superannuation fund were to invest in an external bond fund, it need only disclose the name of the fund manager, obscuring whether the investment was in Australian government debt or emerging-market bonds, and so on.

- Australians looking to invest sustainably have no regulatory enforced way to know if they are exposed to fossil fuels.

- The current Australian Portfolio Holdings Disclosure Regulations only require a semiannual disclosure and don't cover managed funds. Unless the fund is a related party to an Australian registrable superannuation entity and managing superannuation fund assets, there will be no portfolio disclosure obligations.

Australia's current portfolio holdings regulations offer little value to Australian investors and do not exceed the lowest bar that Morningstar sees in disclosure regulations in other global markets. In Australia's compulsory superannuation system, investors' best interests are not being served by weak portfolio holdings disclosure regulations

Australia's current portfolio holdings regulations offer little value to Australian investors and do not exceed the lowest bar that Morningstar sees in disclosure regulations in other global markets. In Australia's compulsory superannuation system, investors' best interests are not being served by weak portfolio holdings disclosure regulations